News

The High Court in Northern Ireland awarded substantial damages to a young woman who was injured when the rear door of a moving bus opened and struck her.

Read more

How are e-bikes viewed in law and what is the legal position if you are injured through the fault of someone riding an e-bike?

Read more

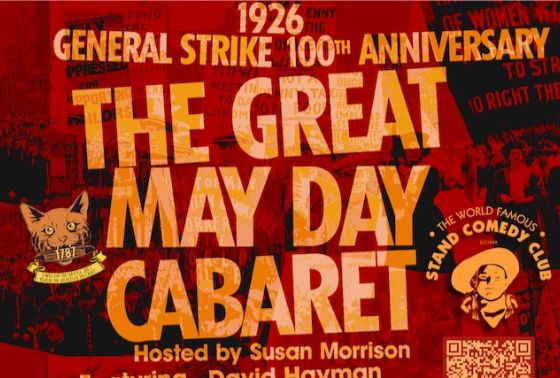

We are delighted to be supporting the Great May Day Cabaret on 4 May 2026 at The Stand Comedy Club, Glasgow.

Read more

A guide for families: a Guardianship Order is an order granted by the court which authorises the guardian to make decisions on behalf of the adult who lacks capacity.

Read more

Sometimes, an injured person may believe they cannot claim if a third party has had a role in causing their injury

Read more

A Sheriff has rejected an argument that a low velocity road traffic accident could not cause injury.

Read more

Allan McDougall Solicitors has been shortlisted for two awards in The Herald Law Awards of Scotland 2025.

Read more

The pinnacle of Keir Starmer’s Labour government, is due to receive royal assent later in the year.

Read more

Alice Bowman spoke with The Herald about why the new Employment Rights Bill is desperately needed, provided it delivers what it promises.

Read more

A judge at the High Court found an NHS Trust was negligent in a decision that will have implications for clinical practice across the UK

Read more

Alex Robertson, an associate in our personal injury team, has been certified by the Law Society of Scotland as a Trauma-Informed Lawyer.

Read more

Allan McDougall Solicitors has boosted its family law team with the appointment of Hannah Ironside as a solicitor based in the firm’s central Edinburgh office.

Read more